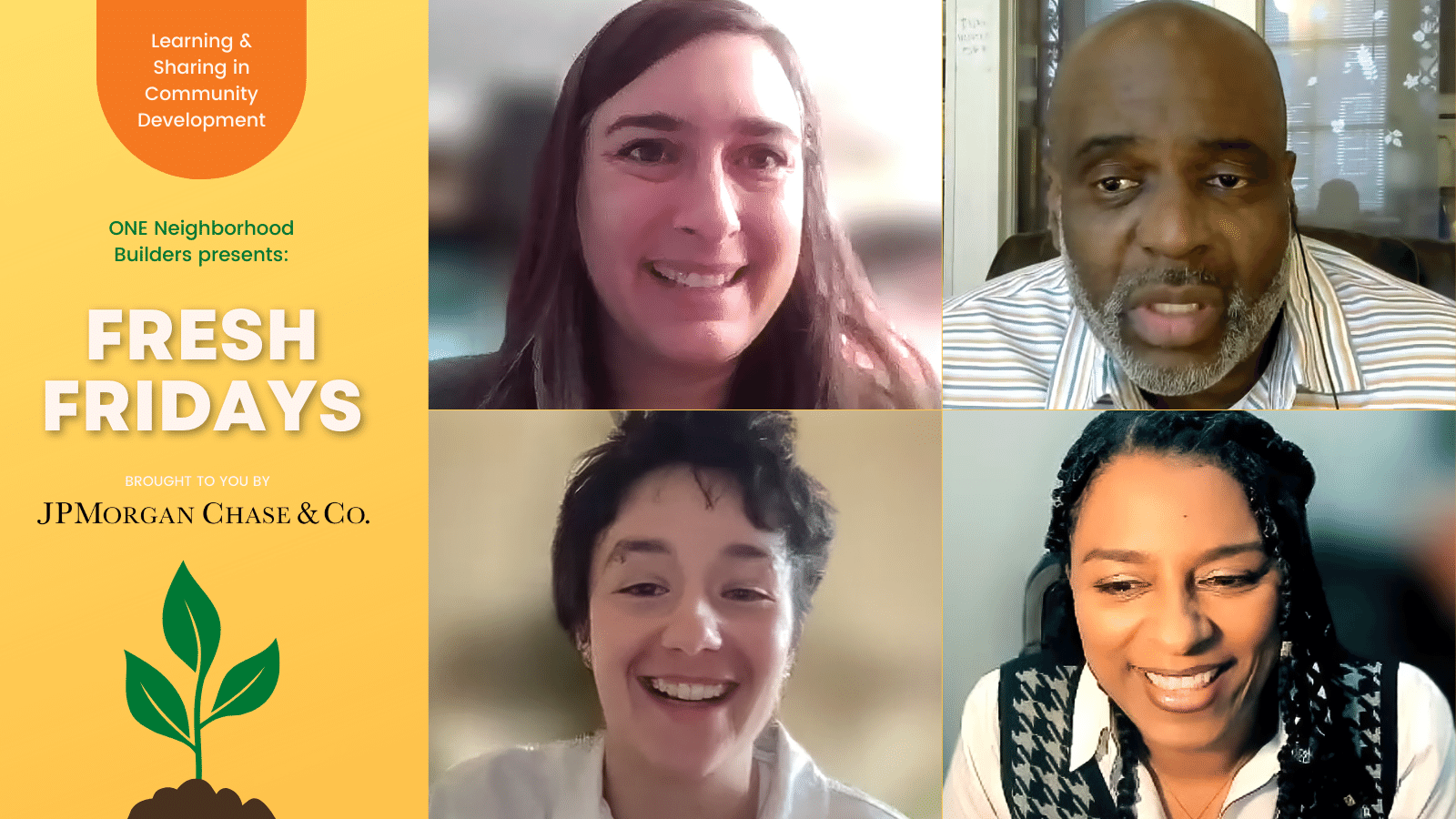

Top, from left: Jenee Gaynor, Director of Shared Equity Housing, NeighborWorks America, Aubrey Collins, Homeownership Program Coordinator, Church Community Housing Corporation (Newport)

Bottom, from left: Nora Gosselin, Market Development and Acquisition Specialist, New England Resident Owned Communities, Cooperative Development Institute, Belinda Philippe, Director of Community Building & Operations, ONE Neighborhood Builders (Providence)

More than 30 people attended Fresh Fridays on March 17, 2023, to discuss Shared Equity Housing.

The panelists included:

- Jenee Gaynor, Director of Shared Equity Housing, NeighborWorks America

- Aubrey Collins, Homeownership Program Coordinator, Church Community Housing Corporation (Newport)

- Nora Gosselin, Market Development and Acquisition Specialist, New England Resident Owned Communities, Cooperative Development Institute

- Belinda Philippe, Director of Community Building & Operations, ONE Neighborhood Builders (Providence)

Panelists speak about the benefits of Shared Equity Housing

Jenee Gaynor, Director of Shared Equity Housing at NeighborWorks America, spoke about Shared Equity housing, which allows people to access affordable homeownership at below-market rate cost. She said models of Shared Equity housing have become more popular in recent years in hot real estate markets and other places where gentrification is an issue.

She gave a detailed explanation of the different models that fall under the term Shared Equity Housing. Community Land Trusts are one of the most commonly known forms of Shared Equity housing, she said. The CLT model was started by civil rights leaders in the south, who were looking to create secure tenure for black farmers, she said. It involves an organization taking ownership of land and allowing the community to decide what they want or need. Often, the decision is to use it for affordable housing or homeownership to create a stabilizing long-term presence in the community.

She also discussed housing co-ops, which have a long history in the U.S., dating to the 1920s-1940s, she said. With co-ops, tenants in a building — former renters – have an opportunity to become owners. They purchase the building and then create a co-op. This creates community control and an agreement that the community, not the landlord, owns the property.

Lastly, she mentioned that deed restrictions have become increasingly popular. Deed restrictions are legal agreements used to restrict the sales price of a property, ensuring that the housing units remain affordable over time.

Aubrey Collins, Homeownership Program Coordinator for Church Community Housing Corporation in Newport, shared information about its land trust model, which has been in place since 1994 and currently includes more than 100 homes. In the land trust arrangement, residents own the home, but not the land. He said to be eligible, families must fall within a specific area’s median income and homebuyers must complete a training course, which covers details of the nine-year ground lease.

He said the land trust model has been successful in providing affordable housing to families in Newport, where “gentrification is a real thing,” and the average price of a home is $635,000. Land trust resales, he said, are around $230,000.

Nora Gosselin, a Market Development and Acquisition Specialist at Cooperative Development Institute, said they help communities transition from investor-owned communities to resident-owned cooperatives in New England and New York.

She explained that in investor-owned communities, residents own their homes, but the landlord owns the land. And this can cause problems for residents because they are homeowners and renters at the same time. They can’t move easily and they could face rent hikes or face other issues out of their control.

But in a residential cooperative, she explained, residents collectively own the land beneath their homes and the common infrastructure. They operate as a nonprofit, which means they do not have to worry about a landlord profiting from their community. Instead, an elected volunteer board of directors handles their budget and ensures their money stays within the community.

Belinda Philippe, the Director of Community Building and Operations for ONE|NB, discussed the use of community land trusts and deed restrictions — and said ONE|NB learned lessons from both.

Philippe explained that ONE|NB initially used community land trusts to provide affordable homeownership opportunities for low and moderate-income residents in Providence, but it didn’t work as expected. Residents struggled to pay minimal fees associated with the land use, and lenders did not understand the model, she said.

In response, ONE|NB shifted its focus to deed restrictions. Deed restrictions place legal restrictions on how the property can be sold, she said. This enables the property to remain affordable in perpetuity. She explained how outside sources and funders are used and they impose income guidelines requiring homes to be sold only to people who meet those guidelines. This provides long-term stability for low to moderate-income families and creates a sense of community ownership, she said.

She said that in the last three years under the deed restriction model, ONE|NB has developed nine homes in Providence: Five condos at Sheridan Small Homes, and four residential/commercial units at Manton Avenue Live/Work townhomes. She noted that recently, ONE|NB’s program Protecting Providence Properties recently had its first tenant purchase the home they had been renting.